I tried to reel you in with a scary headline. I hope it worked. My purpose is not to be dramatic but to share with you the reason why “now” is the time to get into the market. Buyer or seller. Today’s market offers benefits to both sides.

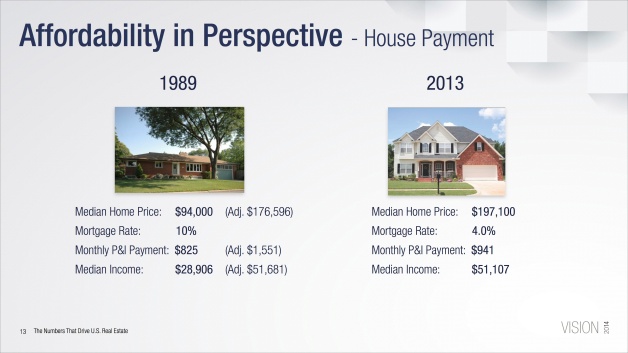

But first, a discussion about affordability. When I refer to housing affordability, I am referring to the percentage of a household’s income that must go to make the principal and interest payments on a home mortgage. Historically, it would take 21.6 percent of a family’s household income to cover their principal and interest payment. That would then leave 78.4 percent to pay for everything else in your life. Not too bad right?

Well it could be better. Take a look at the graphic below: At the end of 2013 it took only 14.2 percent of the household income to cover housing costs. That is 6.4 percent below the historical average. Now here is the kicker. If you look at 2012, the percentage was 12.7 percent. Therefore, in one year we have seen a loss of affordability of 1.5 percent. At that pace we would be back to the historical average in less than five years. Truly, I don’t see it taking longer than four years. And here is why.

At the end of 2013 it took only 14.2 percent of the household income to cover housing costs. That is 6.4 percent below the historical average. Now here is the kicker. If you look at 2012, the percentage was 12.7 percent. Therefore, in one year we have seen a loss of affordability of 1.5 percent. At that pace we would be back to the historical average in less than five years. Truly, I don’t see it taking longer than four years. And here is why.

The combination of slowly rising interest rates and rapid appreciation of home values have set us on a course for more losses in affordability. As I shared in my last column, the appreciation of the median home value was up 11.5 percent in 2013. I would bet we will see a higher increase in 2014 based on current trending.

If you have heard the term “house poor” before, or you have been house poor before, then you clearly understand affordability and the impact that it can have on your life. By house poor, we mean that your housing costs are such a large percentage of your income that you don’t have anything left to do the fun things in life. Fun things like vacation, or home improvement projects, or just a nice dinner out. So think of it this way: As housing affordability decreases, so can your choices around where you spend your money. And isn’t it better to have more choices?

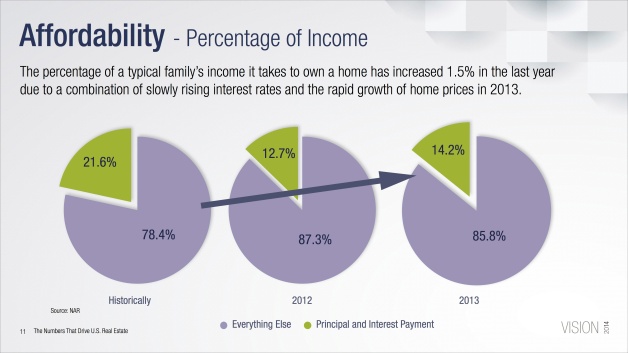

Take a look at the slide below putting housing affordability in perspective.

If you look to the left, you will see some housing statistics from 1989. The numbers to the right in the brackets are adjusted for historical inflation (2 percent per year). The mortgage rate in 1989 was 10 percent. If you glance to the right, you will see the average mortgage rate for 2013 was 4 percent. Now look at the monthly mortgage payment in 1989. It was $825. If you adjusted that payment for inflation, it should be $1,551. But it is not! Instead, due to low interest rates and a corrected housing market, that payment is $941. Today’s affordability is saving you more than $600 a month. WOW! Affordability is truly the gift of today’s real estate market.

Finally, both buyers and sellers are impacted by decreases in housing affordability. As interest rates and home values increase, buyers are steadily losing buying power. A good rule of thumb is that a buyer will lose 10 percent of his or her buying power for every 1 percent increase in interest rates. For example, if a buyer were looking to purchase a $250,000 home based on her comfort level with the mortgage payment, and rates then increased by 1 percent, she would then have to purchase a $225,000 home to keep the mortgage payment the same. In our market, $25,000 can make a big difference in the size, location, and overall level of update in a home.

The other side of the coin is that as rates and values improve, some buyers will be forced to purchase less of a home or even choose to leave the market altogether. Fewer buyers equals less demand. A smaller buyer pool (less demand) may force a seller to concede more than he would have to in a stronger market. And when the seller does sell, the current rate will also affect their buying power.

I will say it again, affordability is truly the gift of today’s real estate market. Unwrap it why don’t you?